Modern Challenges and Innovative Tools for Sanctions Compliance

Challenges of Sanctions Compliance

Financial institutions need to meet growing sanctions compliance demands without disrupting customer

services, incurring an exorbitant overhead, and being exposed to regulatory fines.

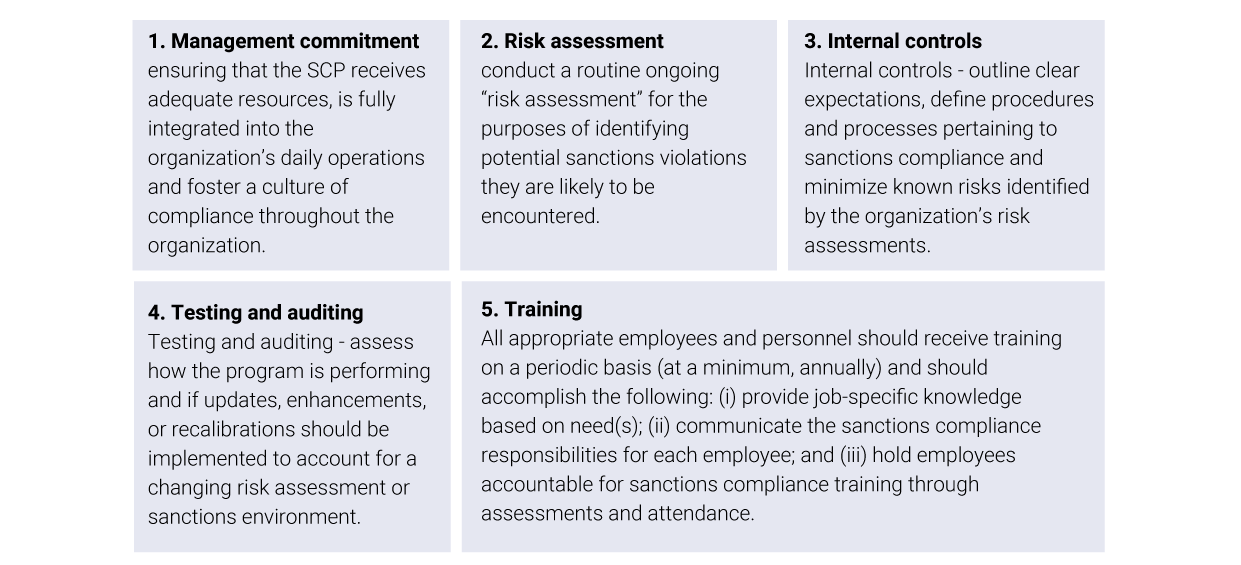

Regulators strongly encourage financial institutions to employ a risk-based approach to sanctions

compliance by developing, implementing, and routinely updating a sanctions compliance program (“SCP”).

While each risk-based SCP will vary depending on a variety of factors—size and sophistication, products

and services, customers and counterparties, and/or geographic locations—each program should be

predicated on and incorporate five essential components of compliance:

Sanctions screening involves reviewing individuals, organizations, vessels, aircraft, and geographical

jurisdictions listed in transactional data, employees and contractors, and customer KYC information,

followed by vetting them against country-based and list-based sanctions. Country-based sanctions reflect

embargoes, such as the embargo on Cuba, while list-based sanctions focus on individuals and entities,

such as terrorists. Sophisticated name checks and list screening tools are instrumental in determining if

there is a connection with a sanctioned individual or entity.

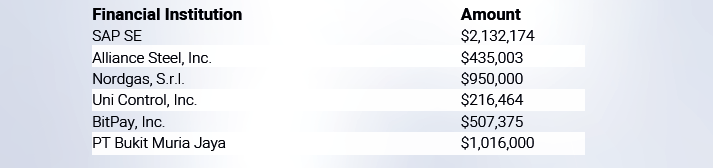

Hefty fines against financial institutions for failing to comply with AML laws and regulations have

increased in recent years and is testament to the growing difficulty of adhering to sanctions compliance.

Penalties and fines not only affect financial institutions’ net value, but also their reputation.

Effective Tools for Sanctions Compliance

While robust filtering technology is essential to staying compliant, the most cost-effective approach

combines intelligent technology, people, and processes with self-learning. Effective technology must have

the capability to self-learn, which will systematically decrease the number of “False Positives.” Precise and

cost-effective controls meeting the demands of regulators and customers will form an integrated

sanctions compliance program. The onus is on financial institutions to detect, measure, and accept

risk(s), and it is a fine balance to find solutions that are effective and efficient in monitoring and screening

transactions. Areas of Sanctions Technology:

• Lists: criteria and technology processes to ensure that lists are only screened against a subset of data

relevant to a specific jurisdiction• Exclusions: exclusion of a party from screening that poses low sanctions risk or the use of conditional

screening rules using list data or source data attributes

• Suppression: use of suppression rules or “Good Guys” lists to manage common false positive alerts

requiring unnecessary manual review. Suppression rules help reduce false positives by

applying very specific logical conditions before generating an alert. On the other hand, “Good

Guys” lists work by suppressing unnecessary alerts on previously known false positives.

• Data: Data Attributes are specific pieces of identification information included in the Firm’s Reference

and Transaction Data. The screening requirements for Data Attributes are categorized in three ways:

- Mandatory – Data Attributes that must be screened;

- Screened If Available –Data Attributes, if available, must be screened; and

- Supplemental – Data Attributes, if available, will be used for alert clearing, but not for screening.

Strong data governance/management processes are imperative to reducing the noise. If the data is

frequently incorrect or not available, financial institutions should consider improving data quality.

Poorly configured screening software is often a contributing factor for regulatory fines. This is leading

many financial institutions to abandon manual reviews and outdated sanctions screening systems in

favor of more customizable and sophisticated technologies. This framework is also helpful during the

vendor selection process for the financial institution’s Sanctions screening program.

Other factors to consider when selecting a vendor for screening software are:

• Transactional Volume

• Technology Synergy

• Repository of Matching algorithms

For larger or more complex financial institutions, there is an expectation that the screening program will

require the use of a technology application that includes certain core functionalities to ensure appropriate

alert creation by, and governance over, the screening process. Such functionalities include the capability

to implement risk-based screening rules, generate high quality alerts for review, provide applicable

metrics and reporting, ensure data integrity, and facilitate independent testing and validation. A robust

operating model employs expertise from IT, Operations, and Financial Intelligence Unit (“FIU”) working

together to ensure appropriate alert generation and disposition.

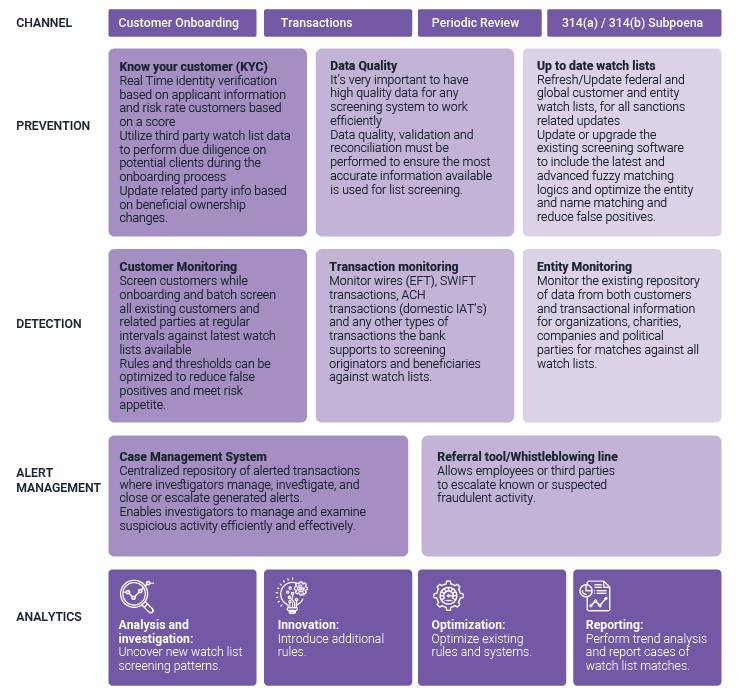

The figure below details the key components of a technology framework that are critical in the

success of a robust SCP:

In 2014, OFAC’s amended its “50 Percent Rule” to state that the property and interests in property of

entities directly or indirectly owned 50 percent or more in the aggregate by one or more blocked persons

are considered blocked. OFAC “urges caution” even when an SDN has significant ownership under 50

percent, or an entity is controlled (but not owned 50 percent or more) by one or more blocked persons.

This presents its own challenges as financial institutions need to ensure that they have a proper KYC

process in place to identify related parties of the entities, and ensure that they are screened as part of the

screening program.

The burden of finding these bad actors, equates to a range of tools and budgets for a comprehensive and

robust Sanctions Compliance program at financial institutions. Institutions must invest in new and

sophisticated technologies capable of automatically screening huge volumes of transactions and

precisely identifying suspected violators. This adds a layer of complexity as financial institutions need a

watchlist management system to review, update, and monitor any changes in the various watchlists.

Sanctions screening involves reviewing individuals, organizations, vessels, aircraft, and geographical

jurisdictions listed in transactional data, employees and contractors, and customer KYC information,

followed by vetting them against country-based and list-based sanctions. Country-based sanctions reflect

embargoes, such as the embargo on Cuba, while list-based sanctions focus on individuals and entities,

such as terrorists. Sophisticated name checks and list screening tools are instrumental in determining if

there is a connection with a sanctioned individual or entity.

Benchmarking Screening Capabilities

While no sanctions screening tool is perfect, it is important to understand the limitations of its technology.

Risks and their risk mitigation controls should be appropriately assessed and documented by performing

an impact assessment.

To validate the effectiveness of their compliance program, financial institutions should perform

independent testing of their Sanctions screening technology. This usually involves passing a test dataset

through the Sanctions screening tool in order to assess its effectiveness and the output data’s quality of

“matches”. Additionally, the output should be evaluated to make sure that all the relevant critical fields

(such as all available party name fields and country related fields within the transactions) are properly

mapped and monitored by the Sanctions screening tool. The real-time dataset should be a sample of

transactional data that will be tested in an environment similar to real-time screening in production at the

institution; this sample should contain a homogenized mix of various transaction types and message

types that are offered by the institution. Whereas the batch screening dataset should be a reasonable

representation or synthetic data of the institution’s customer base, customer types, and geographies.

While testing the different screening capabilities (batch and real-time) provides the institution a level of

confidence that all relevant data is processed by the screening solution, synthetic test data containing

known name variations and typologies of sanctioned individuals/entities should be used to establish a

benchmark for the screening solution. The results from the synthetic test data will provide the institution

with an indication of the controls provided by the screening solution and assess if any additional

mitigating controls or processes are needed based on the performance of the solution and the actual

customer/transactional data. Not every screening solution is created alike, and the functionalities and

algorithms are often black boxes that do not yield the same results when compared side-by-side. The

financial institution must ensure that they have the methodology, testing artifacts, and other

documentation available to demonstrate the “how” and “why” of the screening solution settings.

Due to the severity of fines associated with missed OFAC SDN matches by financial institutions, it is of

great importance to ensure that there are no true positive hits that fall through the cracks. As such,

modern sanctions solutions offers additional capabilities using more advanced algorithms and

techniques to capture potential matches in addition to the traditional exact name matches.

The robustness of these new techniques however typically leads to higher numbers of false positives and

requires a balance of risk tolerance in order to not overwhelm the capacity of investigations resources.

Why Matrix-IFS?

Regulators are looking for financial institutions to implement sufficient controls within their Sanctions

Screening program, and it is the responsibility of the financial institution to have thorough knowledge of

the risks associated with their products, geographies, and customers from both a qualitative and

quantitative perspective – which is especially important now, given the dynamic and fast changing

regulatory environment. An effective Sanctions Screening Program is a combination of policies,

procedures, and technologies that enable a financial institution to ensure that it does not provide direct or

indirect services to sanctioned parties, without a license and the approval of OFAC.

Matrix has helped global top-tier financial institutions implement, upgrade, and tune their sanctions and

list screening solutions, with leading vendor solutions from Actimize, FircoSoft, Accuity, LexisNexis, and

RDC. Our team consists of regulatory and technology subject matter experts, including former

compliance executives and product development experts, with a strong foundation and deep

understanding of compliance regulations, policies and procedures, and risk drivers to ensure these

Sanctions compliance programs meet industry standards and regulatory expectations. The Sanctions

framework developed by Matrix is solution agnostic and allows for easy identification of key Sanctions

related risks at a financial institution based on their products and services, customer types, and

geographies. Matrix developers have hands-on experience implementing out-of-the-box and custom tool

features that fit the customer type and risk profile for these organizations. The expertise of both advisory

and implementation experience across vendors ensures that the solution-specific functionalities are

considered.

Find out more

Please complete your details and we will contact you

Enter your contact details

Please submit your details

Enter your contact details

Please submit your details