Webinars On-demand

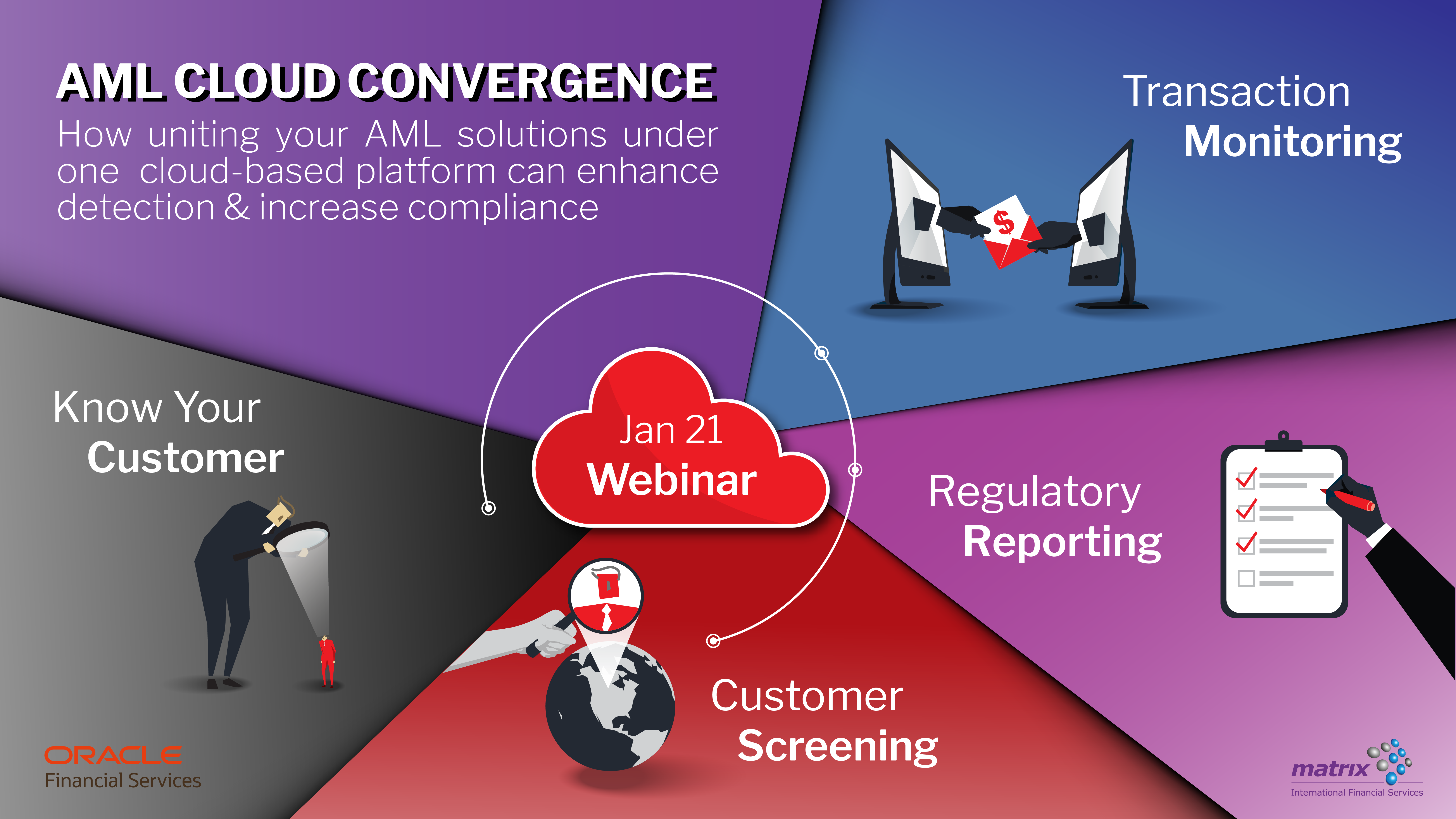

AML Cloud Convergence

When it comes to AML solutions, midsized banks have had to compromise innovation and operational efficiency due to budget constraints. Fortunately, they no longer need to do this. With cloud-based managed solutions, state-of-the-art AML systems are more affordable than ever before.

In this webinar, Oracle and Matrix-IFS host a panel discussion with Sunflower Bank & Community Federal Saving Bank to discuss a cost-effective alternative to inefficient legacy systems; an integrated, cloud-based approach that combines Transaction Monitoring, KYC/CDD, Customer Screening, and Regulatory Reporting.

The Great Transformation: Banking and Compliance Post-Pandemic

Increased digitalization is not only shaping modern banks but is also becoming imperative for banks to stay competitive. A panel of experts; Ted Sausen, NICE Actimize and Omesh Bhatt, Matrix-IFS will share insights into the industry transformations that began pre-pandemic but have since accelerated dramatically due to a shift in banking consumer behaviors. Learn how your AML program can embrace the current era of innovation while ensuring compliance amidst emerging risks and regulatory changes.

Topics that will be discussed:

– Expedited changes due to pandemic

– Increased closing of branches

– Cryptocurrency and other emerging risks

– Advanced analytics and biometrics

– Increased digitalization

– Navigating AML between Emerging Risks and

Regulatory Changes

– Survival methodology for banks

– Modifications in the Actimize product

– The outlook for banks moving ahead

– Live Q&A

Improve Sanctions Program Controls and Reduce False Positives With Next-Gen Tech

With frequent regulatory changes, rising geopolitical tensions, and ever-increasing false positives, financial institutions should take advantage of proven market best practices to combat financial crime.

In this webinar, Matrix-IFS & Oracle present methods to leverage smarter processes and innovative technologies to maximize the effectiveness of your sanctions program. It will also touch upon the concept of building a collective intelligence platform for the entire financial industry to fight against financial crime.

Integrating eComms & Control Room Surveillance

Many organizations have attempted to monitor MNPI in their eComms surveillance controls with very limited success, substantial overhead, and strain on compliance resources. Recent advances in machine learning and AI have made the development of innovative eComms solutions possible and available to compliance professionals and regulatory bodies.

During this webinar, Matrix-IFS will present industry trends, common challenges and pitfalls when integrating eComms with Control Room surveillance.

Implementing & Maintaining a Healthy AML Program

During this webinar, Matrix-IFS and Bottomline Technologies will walk you through the steps necessary to implement a well-functioning AML transaction monitoring & sanction screening system, and how to ensure it operates long after go-live.

Topics Covered

1. Common AML implementation frustrations & pitfalls

2. Guidelines for a proper AML implementation

3. How to monitor Data quality to ensure a smooth system operation

4. AML solution Demo

Building a Robust AML Data Governance Program - Why, How & Where

Without a reliable Data Governance program in place, AML and Surveillance compliance teams are essentially flying blind; poor data quality causes models to generate incorrect results, missing data may result in false-positive/negative alerts, and misaligned communication between compliance and IT teams could result in regulatory coverage gaps.

During the webinar, Matrix-IFS’ experts will discuss the importance of a proper data governance program for healthy and effective AML and Surveillance programs, and how to build one from the ground up.

Model Validation Best Practices

Matrix-IFS 5-step, best practice approach:

- Governance, Policies, and Controls Review

- Data Assessment

- Conceptual Soundness of Design

- Design Implementation Review

- Output Performance Assessment

AML Compliance in FinTech Webinar

FinTech companies have AML compliance challenges that differ from those of traditional financial institutions. One of the main struggles is the lack of out-of-box solutions that could match their unique business models. To be compliant, they must adapt an existing off the shelf solution or create a brand new one – both options involving considerable cost and risk. Other challenges involve issues around scalability, budget constraints, lack of FinCrime domain and expertise, and more.

During this workshop, Matrix-IFS will discuss the unique AML Compliance issues FinTech and offer cost-effective and scalable solutions.

NY DFS 500 Cyber Security Regulation Readiness Webinar

NY DFS 500 regulation, which will take effect on June 01, 2020, is designed to promote the protection of customer information as well as the information technology systems of regulated entities. During this webinar, our cybersecurity experts summarize and simplify the regulation’s requirements including who does it affect, what are the requirements, and offer recommendations on how to achieve compliance.

Tuning & Model Validation Accelerators for Transaction Monitoring & Sanctions Screening

In this webinar, Matrix IFS will discuss how to use advanced analytics tools to accelerate model validation & tuning processes independently of the TM & OFAC systems and how to accelerate compliance with regulatory standards.

.

Cost Conscious Compliance in AML

In this webinar, we will demonstrate how to measure the success of your AML Compliance & Financial Crime Programme. In addition, we will discuss methods for optimization, use cases and share insider tips to cost reductions.

Data Quality - Efficiency & Effectiveness

This webinar will discuss the specific advantages that improved data quality can deliver to make your financial crime program. Learn how to measure and improve Data Quality Efficiency/Effectiveness and witness Pitney Bowes’ graph visualization demo to drive investigative Efficiency and Effectiveness.

Data Quality - Account Matching & Linking

During this webinar, we will discuss Data Quality challenges and demonstrate techniques that will enable your organization to improve the detection of suspicious activities by better understanding your customers and their network.

Data Quality Automation Webinar

In this webinar, we will explore the best practices for setting up a robust data quality automation program for a financial crime unit (Fraud Prevention and AML) and talk about solutions and components (visual & analytics) that can assist the FIU/AML Investigations.

Real-time Mule Accounts Detection

During this webinar, Pitney Bowes and Matrix-IFS will explore the threats of Mule Accounts and present a cost-effective solution, that combines data analytics and model tuning to detect and stop them, when it counts.

4 Simple Steps to Achieve GDPR/CCPA

During this session, we will discuss the regulatory requirements of GDPR with respect to Fraud and Compliance technology and present a simple solution for all of your compliance needs, using one managed platform.

5th AML Directive Readiness Webinar

During this webinar, Matrix-IFS and Pitney Bowes will explore the challenges that derive from the 5MLD and offer an affordable solution that is based on the institution’s existing AML system.

TM Implementation Best Practices

Learn best practices for designing and implementing an effective transaction monitoring system based on the experience of over 200 TM implementation project.

AML Transaction Monitoring Tuning

Learn how Financial Institutions can leverage advanced analytics techniques to improve the productivity of the rules by setting up appropriate thresholds and how to leverage automation techniques for alert investigation in order to reduce the effort spent on false positives and giving more time for the investigations to focus on the true suspicious activities.

Open Banking and PSD2 & GDPR Regulations

The purpose of this webinar is to help Financial Institutions understand the implications of financial crime and fraud prevention, and get ready to review and upgrade their systems accordingly where required.

Automation (RPA) for AML & FIU

During this session, we will explore a new vision of a modern FIU department, which would incorporate Artificial Intelligence, Machine Learning and advanced analytics to address and reduce your alerts as well as how robotics and automation can play part in reducing risk and simplifying the work of the investigators.

Deal & List Management Systems

During this session, we will explore the complexities around streamlining the deal process from a Control Room perspective, presenting a solution that encompasses the full deal lifecycle including workflows, conflict of interest checks, list management, reporting & controls.