Navigating AML between Emerging Risks and Regulatory Changes

Current Regulatory Landscape

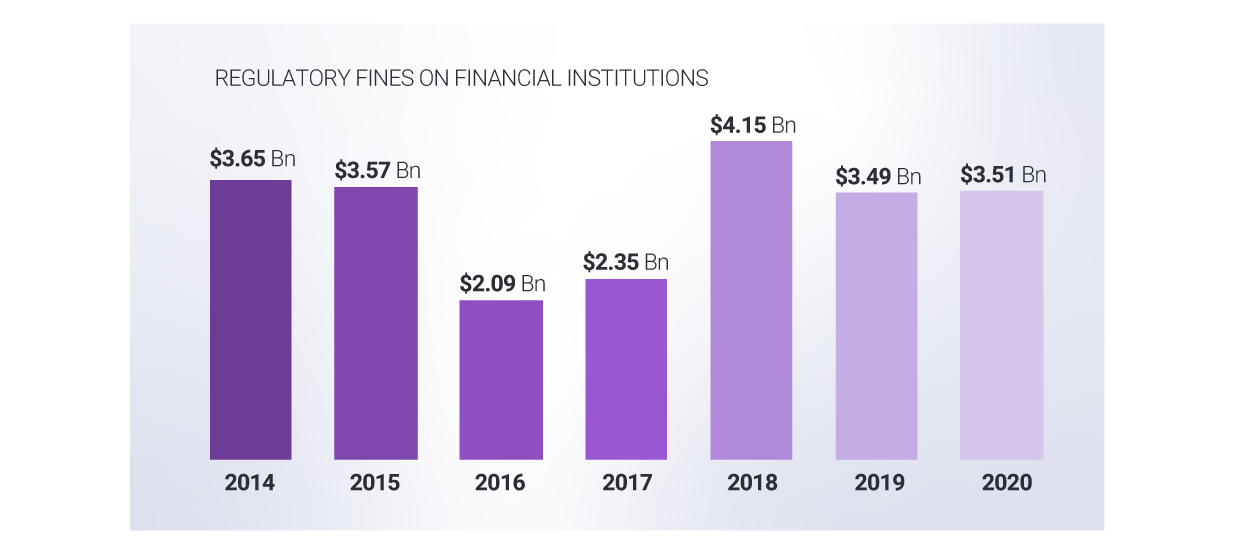

Regulators have fined financial institutions close to 20 billion dollars for Anti-Money Laundering

(AML) shortcomings and regulatory violations in the last 6 years.

OCC Enforcement Actions against Financial Institutions

(2014 to 2020)

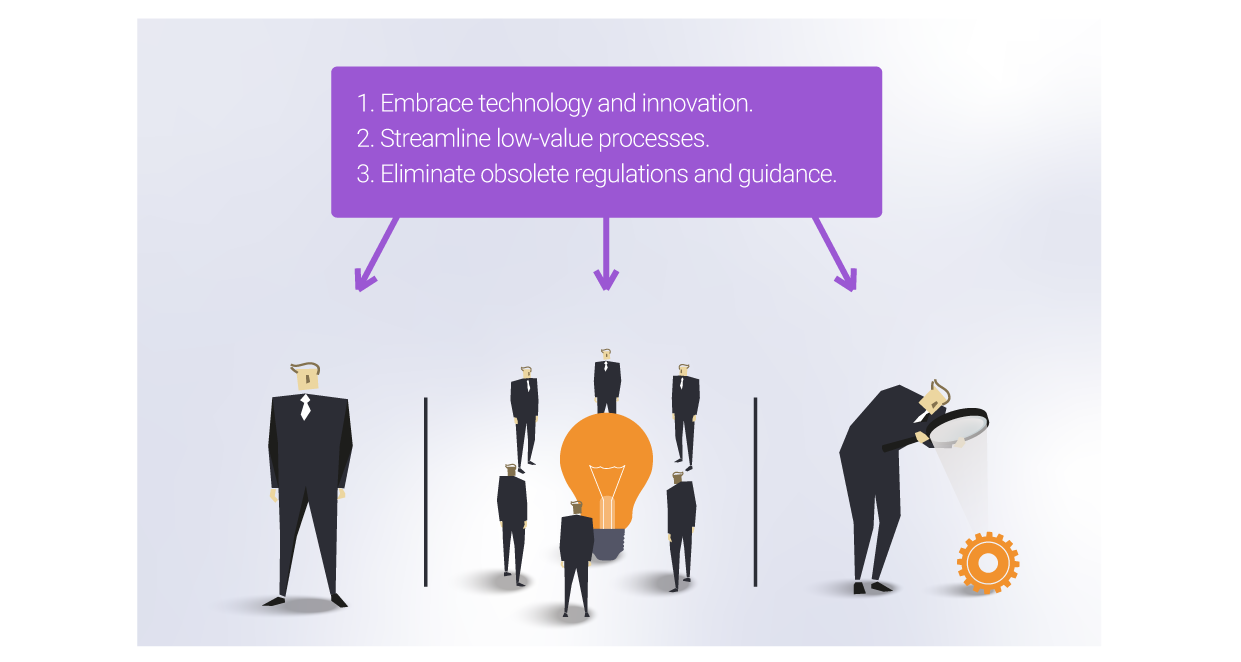

On December 11, 2020, the Senate passed the Anti-Money Laundering (AML) Act of 2020, which

aimed to modernize AML/CFT guidelines by embracing technology and innovation, streamlining

low-value processes, and eliminating obsolete regulations and guidance. This legislation

accomplished its objective by implementing requirements that federal regulators appoint an

Innovation Officer, establish a Bank Secrecy Act Advisory Group subcommittee on innovation and

technology, FinCEN maintain emerging technology experts, and undergo a mandatory financial

technology assessment by the Department of the Treasury.

AMLA’s modernization of AML/CFT

Financial institutions have a crucial role in thwarting money laundering and terrorist financing

infiltrating the financial system. They also face rising pressure to meet their compliance

requirements, with increasing volumes of transactions, outdated technology, and human error.

Additionally, the COVID-19 pandemic has mounted even more pressure on compliance teams to

become more vigilant, as banks seek to quickly mitigate the financial impact of the pandemic

and cybersecurity for remote employees.

Establishing a robust and sound Compliance program is one of the powerful deterrents against

financial crimes; and, when implemented correctly, this program can minimize risk and prevent

regulatory fines. Even though almost all financial institutions have implemented a program that

mitigates exposure to money laundering and terrorist financing, often times these institutions

fall behind with implementing the rapidly changing guidance and requirements by regulatory

bodies. Compliance programs are becoming more complex in order to successfully meet these

changes, incorporating advanced monitoring solutions, artificial intelligence, and empirical

support all the while balancing overhead and resources.

Technological Innovations

The increase usage of machine learning, emerging technological innovations, and sharper

regulatory scrutiny are driving change in combatting money laundering and terrorist financing.

Where the traditional approach requires extensive manual interaction from humans to monitor

and sift through false positives or true hits, the introduction of machine learning in the AML

space has revolutionized the way financial ecosystems work. Machine learning can be

configured to detect various typologies, trends, and behaviors, in order to track previously

hidden patterns of customer behaviors and transactional activities. When compared to the

traditional approach, machine learning generates lower false positives, reduces overhead, and

decreases low-value manual work.

Both technology companies and financial institutions are actively designing innovative solutions

like machine learning to better assess the riskiness of transacting with high-risk geographical

jurisdictions, identify potentially suspicious movement of funds, and detect anomalous patterns

in the transactions. Financial institutions are also investing in advanced analytics capabilities

using intelligent algorithms that allows to convert raw data into valuable insights. Additionally,

many are adopting new technological solutions for deep-dive analyses and dynamic reports,

and creating new data integration and visualization tools that provide more thorough testing, in

order to better identify trends and aberrations of complex criminal patterns.

Emerging Risks

Individuals involved in financial crimes and terrorist financing often change their tactics quicker

than the regulators can keep up. The increased usage of online banking, electric payments, and

virtual currencies assist in remitting and legitimizing illegal funds, which pose a threat to

financial institutions in aiding these transactions and risk regulatory fines. There is a constant

need for financial institutions to continuously improve and maintain their monitoring systems to

detect and address suspicious activities in real-time.

Virtual currencies are fairly new, but have integrated into the financial system at lightning speed

since their inception in 2009. However, financial institutions fall behind regulating them, and

criminals benefit from these shortcomings. The Office of the Comptroller of the Currency (OCC)

recently provided a “green signal” for financial institutions to provide fiat bank accounts and

virtual currency custodial services to virtual currency businesses. Institutions serving virtual

currency exchanges can now engage in using new technologies, like independent node

verification networks (INVNs) and stable coins, to perform bank-permissible functions, such as

payment activities, to address risks and risky behavior associated with virtual currency

transactions: advanced technology, geographical risk, transaction size and frequency,

transaction patterns, and source of funds. On January 14, 2021, FinCEN extended the comment

period for a proposed rule aimed at closing anti-money laundering regulatory gaps for certain

convertible virtual currency and digital asset transactions. In order to keep up with

ever-changing technological and regulatory advances, we implement innovative financial

solutions over more traditional ones, but this also adds to financial crimes and/or terrorist

financing risks.

Apart from virtual currencies, marijuana-related businesses (MRBs) is another market that also

is exposed to money laundering. Most MRBs struggle to find a bank willing to provide basic

depositary and other financial services to them. This is due to the curious legal status of

marijuana as a federally prohibited controlled substance, but a legal and highly sought-after

commodity under the laws of most U.S. states. Currently, thirty-five st ates, the District of

Columbia, Guam, and Puerto Rico have all legalized the use of marijuana to some degree.

As most MRBs cannot obtain traditional banking services, these businesses must deal with an

extensive amount of cash. Thus, the associated compliance costs and risks associated with

MRB banking still can be substantial. This poses a fascinating mix of opportunity and risk from

an AML perspective: although MRBs are no longer illegal under federal law, entities must obtain

licenses under a federally sanctioned state law regime.

With the rise of online gambling, the Casino industry is seeing an upward trend in online betting.

More and more states are legalizing online gambling, including Delaware, Michigan, New Jersey,

Pennsylvania, and West Virginia. Social distancing protocols instituted as part of the COVID-19

response have further resulted in building closures and increased the popularity of these online

platforms. While online gaming may be a new digital industry, their compliance responsibilities

are still the same as that of a traditional casino. Casinos have been defined as “financial

institutions” under the BSA since 1985. Casino (online or offline) also must file Suspicious

Activity Reports (SARs) when it knows, suspects, or has reason to suspect that a transaction or

attempted transaction is linked to illicit activity, or when it is simply inexplicable.

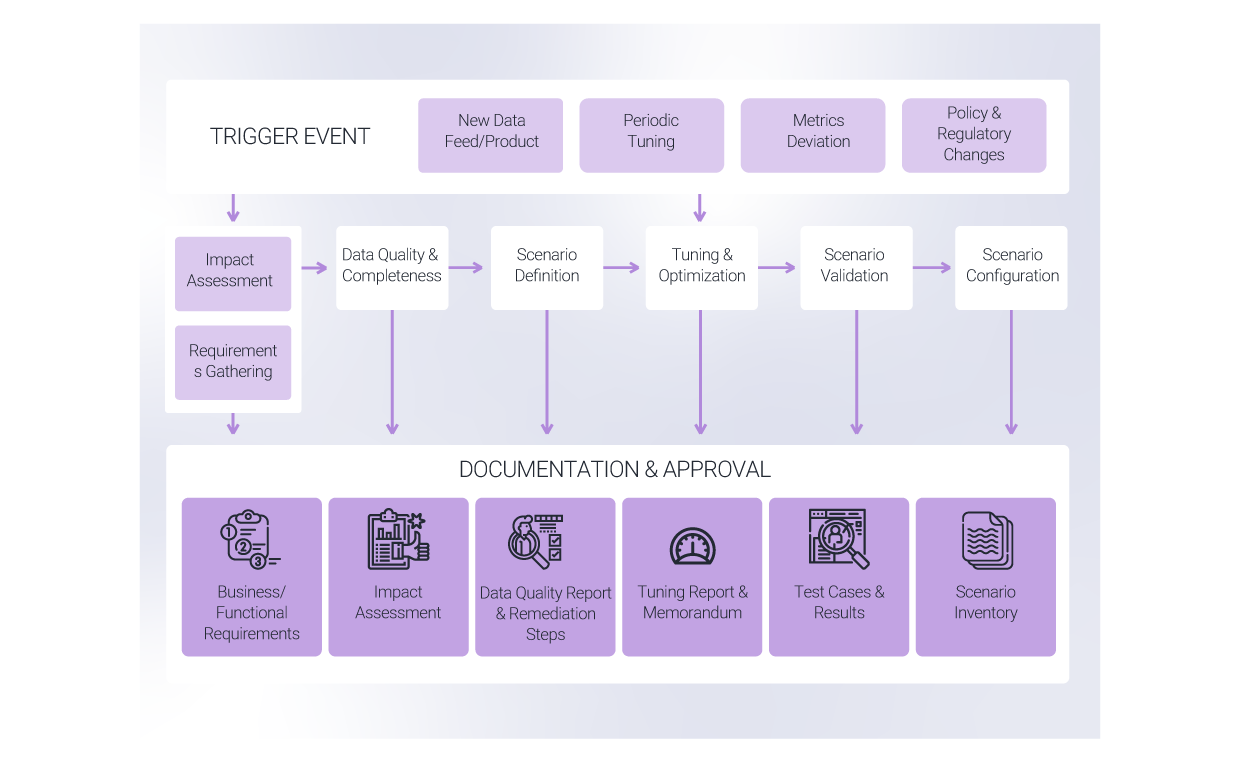

Navigating Hurdles

There is a plethora of tools currently on the market that provide automated transaction

monitoring and machine learning capabilities. Often, the transaction monitoring program is not

relevant to the overall BSA/AML risks faced by the bank, is outdated, or incorrectly calibrated.

Some reasons for this misalignment are that the transaction monitoring program has not been

revisited or reviewed since its implementation or BSA/AML risk assessment review.

As risk assessments are typically conducted on an annual basis, they are often updated only

when a “major event” occurs, such as a merger or acquisition; exponential growth in a new

market area; introduction of a new product or service; and/or significant changes in the

regulatory environment that could impact a financial institution. A financial institutions’ policies

and procedures, such as the risk assessment, should clearly detail the downstream impact

created by these “major events.”

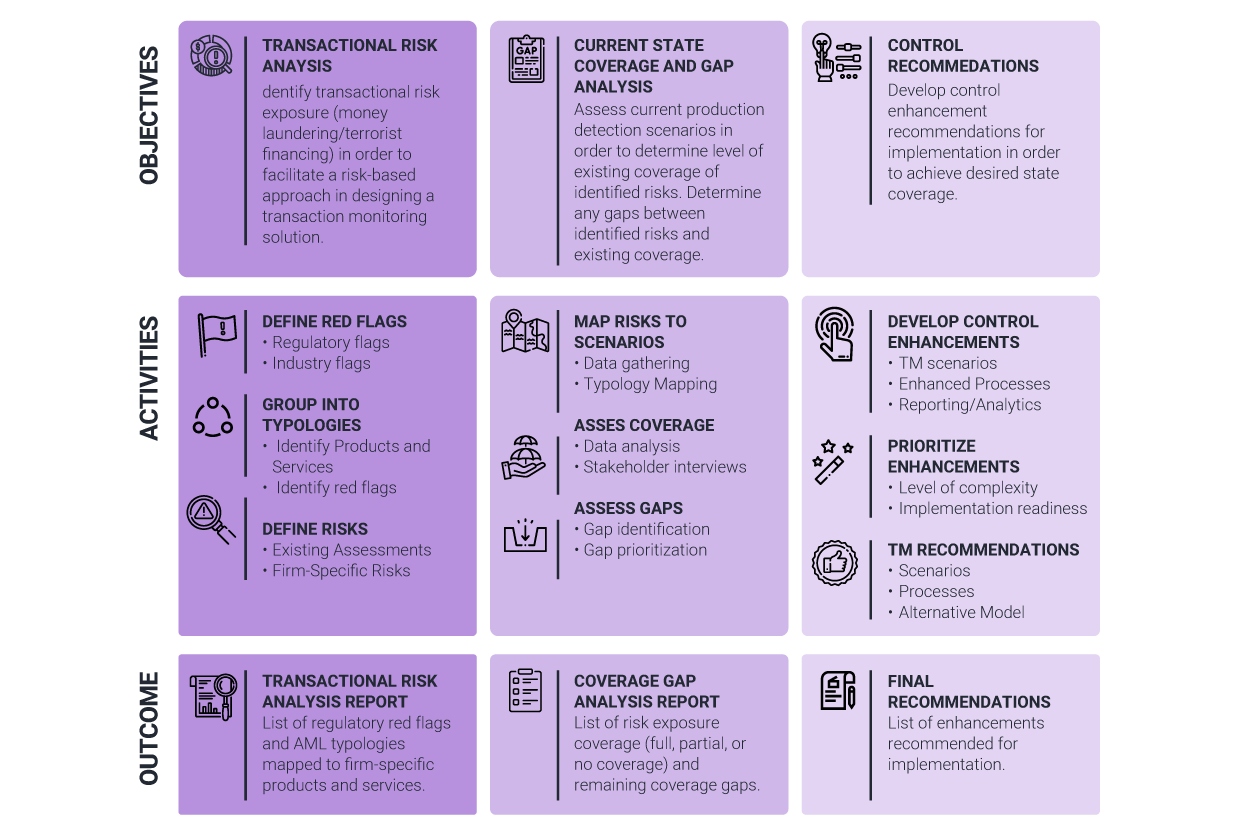

Changes to a risk assessment should also trigger an independent risk coverage assessment to

be revisited for its applicability, which could further warrant a fresh round of rule scenario tuning

exercises; a coverage assessment is a deep-dive analysis of the conceptual soundness of the

model, a firm’s risk exposure, and risk coverage. The assessment determines if there are any

gaps in coverage that exposes the firm to suspicious activity and/or deficiencies in regulatory

guidance. Some examples of what the assessment reviews includes AML typologies, current

rule scenarios, and coverage for “red flags” listed by the regulators.

Why Matrix-IFS?

Regulators are looking for financial institutions to implement an effective risk-based approach

within their BSA/AML Compliance program, and it is the responsibility for the financial institution

to have sufficient controls when reviewing their overall risk profile on a periodic basis.

Demonstrating that they have thorough knowledge of the risks associated with their products,

geographies, and customers from both a qualitative and quantitative perspective becomes a

priority especially given the dynamic and fast changing environment. This understanding is

fundamental for financial institutions to define and manage an effective BSA/AML program that

limits exposure to risks associated with money laundering and terrorist financing.

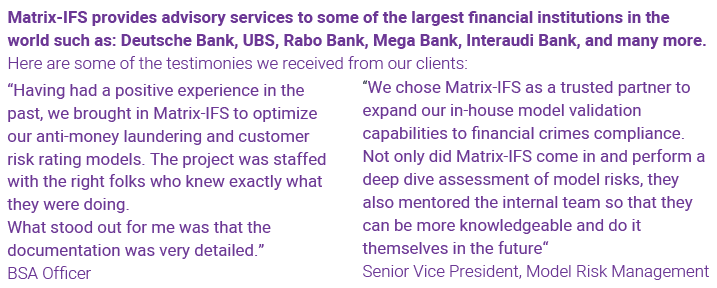

Matrix-IFS provides advisory services to some of the largest financial institutions in the

world such as: Deutsche Bank, UBS, Rabo Bank, Mega Bank, Interaudi Bank, and many more.

Here are some of the testimonies we received from our clients:

Matrix-IFS has not only helped global top-tier financial institutions implement and upgrade

their risk, fraud, and compliance solutions, but is a recognized partner of Actimize, Oracle,

SAS, FISERV, BAE Systems, Bottomline, and Pitney Bowes. Additionally, Matrix-IFS

developers also have hands-on experience implementing out-of-the-box rule scenarios and

creating custom rule scenarios that match the customer type and risk profile for these

institutions. As part of every implementation project, the Matrix-IFS engagement team also

creates documentation, conducts user testing, and provides training and knowledge

transfer to the client’s business and technical teams. Matrix-IFS also offers proprietary

tools as additional services that assist with threshold tuning for Actimize and Mantas rule

scenarios, country code tool for improving geolocation on transactional data, and red flags

library for assessing risk coverage. This coverage assessment framework allows for the

easy identification of applicable red flags/typologies based on the products and services

offered, customer types served, and geographies operated in for each financial institution.

Find out more

Please complete your details and we will contact you

Enter your contact details

Please submit your details

Enter your contact details

Please submit your details