Download Resources

Brochures

Presentation Decks

In recent years, Compliance Leaders have been exposed to various methods to reduce costs of compliance operations: AI, ML RPA, and outsourcing are just some of the examples. The result is a bewildering mix of options, with scarce ‘hard’ data to suggest what is the best approach for an organization. During this event we explored the different ways to measure & optimise AML system to slash compliance costs.

During this webinar, Matrix-IFS and Pitney Bowes will explore the challenges that derive from the 5MLD and offer an affordable solution that is based on the institution’s existing AML system.

Topics covered:

- About the 5MLD and its implication on financial institutions

- Challenges faced by financial institutions with respect to the 5MLD

- Trends in technology: how a relationship based approach improves AML Compliance and reduces cost, enabling Financial Institutions to find, like, contextualise & visualise complex relationships across parties, accounts, and transactions.

During this session, we will discuss the regulatory requirements of GDPR with respect to Fraud and Compliance technology and present a simple solution for all of your compliance needs, using one managed platform.

Topics covered:

- GDPR Implementation guidelines for Fraud & Compliance solutions

- GDPR related technological challenges in the Fraud & Compliance space

- 4 steps for simple compliance – Install. Discover. Set. Go Live

- Customer success stories

Learn how financial institutions can leverage advanced analytics techniques to improve the productivity of the rules by setting up appropriate thresholds and leverage automation techniques for alert investigation.

Topics covered:

- Regulatory Implications

- Managing AML Risks and Emerging Typologies

- Developing Targeted Detection Scenarios

- Customer Segmentation/Population Groups

- Understanding Normal and Outliers

- Operational Improvement Through Automation

A new vision of a modern FIU department, which would incorporate Artificial Intelligence, Machine Learning and advanced analytics to address and reduce your alerts as well as how robotics and automation can play part in reducing risk and simplifying the work of the Investigators.

Topics covered:

- Integrating AML, Fraud and Cyder-security Investigations

- Eliminate Manuel Time Consuming Tasks Using Automation

- Proactive Investigations – System Triggering using AI and Machine Learning Trends

The purpose of this webinar is to help Financial Institutions understand the implications of financial crime and fraud prevention, and get ready to review and upgrade their systems accordingly where required.

Topics covered:

- Overview of GDPR and PSD2 regulations with respect to Financial Crime

- Implications of each the regulations on Fraud and Financial Crime (FFC)

- The challenges and opportunities offered by those regulations

- Which steps should Financial Institutions take to mitigate the cost of FFC

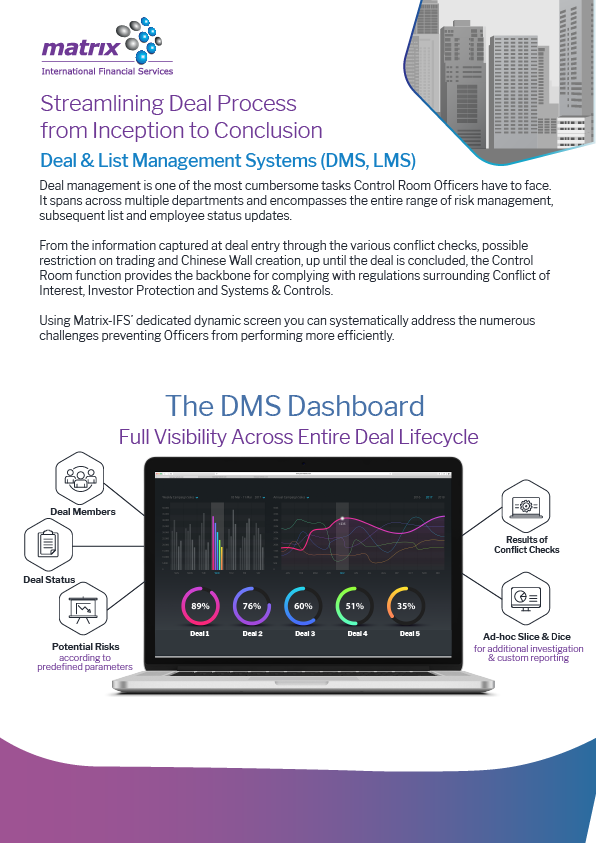

Deal management is one of the most cumbersome tasks of control room officers. It spans across multiple departments and carries the entire risk management and subsequent list and employee status update on its shoulders.

Topics covered:

- The chaotic current state of deal management

- Deal Management challenges

- The solution – Matrix-IFS Deal Management Portal

- From inception till conclusion

- Use case of DMS application and benefits